Bad Decisions Part 2: Easy credit, hard payments

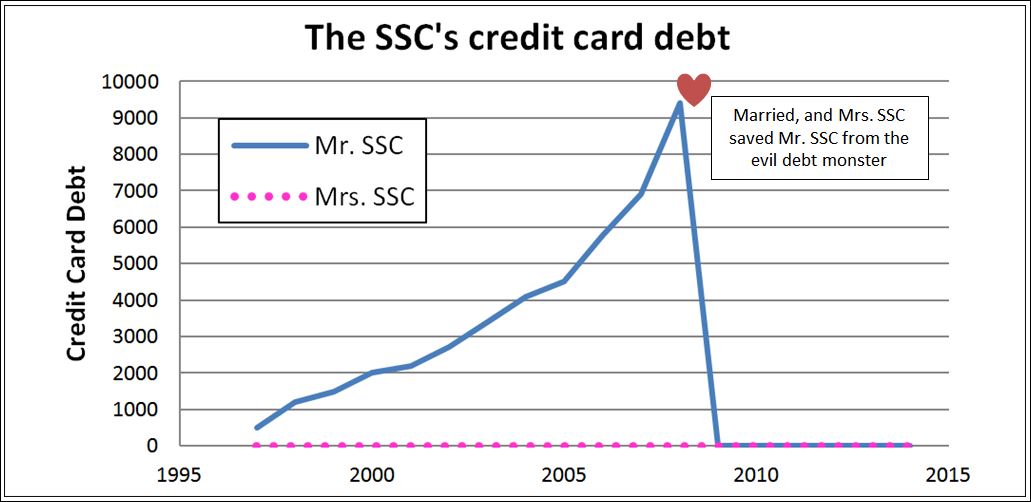

So, when I left off in “Bad decisions: It’s raining student loans” recall, I had been succeeding spectacularly at living above my means utilizing cash infusions through student loans. After school with the bills coming out of my ears, I consolidated those loans, but I had added another $300/month expense to my paycheck off the top. I’m my own worst enemy in a lot of ways, and like student loans, I am almost as bad with credit cards. Fortunately, I don’t have $60k limits on my cards.

My first credit card… oh how I love that memory. I had just spent $700 on frigging books for my first semester and was leaving the used bookstore- yeah these were all used and still added up to $700!! What a racket! Anyway, I passed this little folding table with a cute brunette and some papers on it and she said (in a valley-girl voice, even though we’re in KY) “Hi, Are you interested in applying for a credit card?” I said, “Sure, what’s the catch”? Hahaha, I was and I just didn’t realize it. She said, “None, you just fill out this application, and you’ll get your card in a couple of weeks! Do you have good credit?” I said, “I don’t know, I don’t think I have any credit.” She said, “That sounds great, here’s the application!” It was an application for a Discover card, and while I still have the same account almost 20 yrs later, back then I could only use it at a few places and had to always ask “Do you take Discover?”.

I was good with my Discover card for a long time, mostly because I could only use it at certain places, since they weren’t accepted everywhere back in the 90s. Eventually, I fell off the “good credit card use” wagon and used it like it was tied to actual money I owned (it wasn’t). My downfall started when I was on a crazy New Year’s road trip adventure. I had spent the millennium New Year’s in the Keys because, hey if everything crashed with Y2K, I’m in a good spot right? Except I ran out of money, and somewhere between there and Arkansas to visit family (remember it was a crazy road trip adventure — KY to FL Keys, to AR, back to KY to pack, followed by a move to CO almost 3,800 miles in ~2.5 weeks). I called up to get a cash advancement from my credit card because my bank account was empty and I still had this big trip going on… NEVER do that, it’s like 21% interest and it never gets paid off until you pay off every other dollar first. Big, big mistake. Plus, taking a vacation right before moving across the country and maxing out funds before the move wasn’t the brightest idea either. So, that was my first run-in with a big bill and having to make an effort to pay it down. I literally put it in a drawer and paid extra toward it and it took almost a year to pay off my huge $1800 card bill. But the point is that I did it, and I paid it off even in those trying financial times as a student.

But I didn’t learn my lesson. As soon as the Discover card was paid off, my brain was yelling at me ” Guess what, my card’s back in my wallet baby!! yeah!!! Let’s celebrate!!!” Looking back on that now, it is amazing how much family and friends influence our views of money. A co-worker once told me about her dad being super broke and unexpectedly coming into a chunk of change ~20k, almost enough to cover his debts, and I said, “Oh, is he throwing a party to celebrate?” and she replied, “How do you know my dad?” I said, “I don’t, but I know my dad, and that’s what he would’ve done with ANY extra money.” I treated my finances similarly, I mean monkey see, monkey do, right?

I would go on to repeat this cycle often. Rack up the card, get it maxed out, I’d even get to pay them extra $$ for maxing out my credit line. It seems counter intuitive, but those bastards have it all figured out with loopholes and technicalities for financial idiots like myself. I loved seeing the statements with the “you’re maxed out, let’s charge you XX% interest for that too!” posted there.

I used credit for exactly what the name insinuates, a line of credit I could rack up and then pay down and then rack up again in an endless cycle. I didn’t see that I could do the same thing with just saving money… I needed the immediate gratification of “I need this now, I want this meal, I want these margaritas, I deserve this!” That’s how I felt, and I also felt that saying to someone, “I can’t afford that” was admitting failure at life. This led to the majority of my credit card spending. Well that and impulse buys after 11pm on Amazon (damn you one click ordering!!)

A perfect example is my “Richard Pryor night” as Mrs. SSC puts it. My favorite comedian of all is Richard Pryor, I just get all his humor and can connect to it, and it literally makes me laugh, and feel sad, and back to happy every time I hear it, the guy is just so real and out there with his soul. Anyway, one night I was thinking, I have a few mp3 comedy skits, but what could I get on Amazon? A few clicks later, I have almost all of his recorded shows ordered, a couple of cd’s, and some autobiographies, and a book by his daughter. Well, it ended up being ~$120 of Richard Pryor, and as Mrs. SSC puts it, “Richard Pryor stuff was showing up for days on end.” That was from my allowance (see the allowances post) but still, this is a perfect example of my mentality with spending. This is great, I want this, buy. Oh shiny! I want, buy, buy! Oh shiny! repeat…..

The big point is that when I started out with credit cards I used them for fairly mundane reasons and maybe how they’re intended? Emergencies, car break downs, unplanned contingencies, and not as often to cover a vacation, night out, etc… As you’ll read in my next installment of Bad Decisions 3: Easier credit, harder payments; I cross the line from recreational user to hard core credit card addict. Damn credit cards, damn my impulse buying*, damn my lack of discipline with the 1 week rule because I KNOW I’ll still want some Pryor after 1 week, so why delay it? Impulse buying ruled my life for a long time, and it still takes over occasionally. Mostly, it’s in check now, and luckily, I have an allowance to reign the wild spending in, whether I like that system or not.

What are the habits you find yourself repeating? What do you do to break them? I’d love to hear about it, because as you can see, I’m still having trouble breaking mine… I’ll go into some of my methods to protect me from myself in my next post, but until then, let me know about yours.

*Damn! I just found another few albums of his comedy material and have those on their way to my house in 2 days. Yeah allowance! Looking forward to the commute getting to listen to some “new material”!