February 2017 Spending: Our Money Went Where?!

February was a great month for us! Or maybe it wasn’t who knows? Oh wait, I should know… Maybe I should write “February was A month for us!” and just leave out a descriptor, good or bad. There wasn’t a lot of change although I noticed our “pets” category comprised 10% of our total spend for the month. Yipe! I got a bonus at work – woohoo! That was pretty unexpected considering we still didn’t make money last year, but I am not complaining. Beyond that, it was a pretty normal month. For the number voyeurs out there, here is a look at the charts and graphs of our spending and how it stacks up to last month.

Big Spending Categories

The top 5 spending categories are dominated by mortgage, daycare, pets, allowances, and the kids’ college savings. Pet costs were a lot higher than usual this month. Greyhounds have notoriously bad teeth, and we noticed what looked like a cracked and bad tooth when brushing Lola’s teeth. She had a dental cleaning, but plus side was that February was dental hygiene awareness month for dogs, and we got 20% off on that stuff. Her tooth turned out to be fine, it was just some staining that had it looking so funky. While she was there, she was within a month of her yearly checkup and some booster shots, along with some more heartworm medicine and such. We also got Zoe some new ID tags and between that and the vets it all added up to about $900 worth of pet costs – sheesh!

The kids college funds are trucking along, and with the bonus this month, we will top off their accounts with the after tax remainder. That will get both of their accounts up to $44k and $48k and with a projected 4% growth should get them each around $77k for college. We haven’t decided whether to keep putting in the $800/mo through the end of the year and then call it good, or just call it good right now. The main sticking point is getting more money locked into a tricky place to access it if they end up not using it. Plus, it’s not like we won’t be able to help out from a non-529 account standpoint if it comes to that anyway. Thoughts?

Groceries came in high again and for a short month too – ok it’s only 3 days less than most, but for some reason it feels like a shorter month. Mrs. SSC’s parents were in town for 4 days celebrating her mom’s birthday, so that added some expense in. The rest is just general creep in the grocery bill, so we’ve been keeping a closer eye on it so far this month.

Mrs. SSC’s hobby work spending came in at $545 this month too. That’s her registration for the AAPG or annual petroleum geologist convention – only the best 4 days of talks, posters, and displays around! She did realize that there is some grant money that she can apply for and get reimbursed for this so we’re hoping that goes through. She also got some leads on potential funding and research projects for next year, so that could help with boosting her publishing opportunities, street cred, and possibly even her income. Exciting!

Big Saving Categories

I don’t think there were any big gains or cost reductions this month. Oh, our neighbors have been getting quotes to get the fence replaced – yes that has finally come due – and instead of $900 for the side we share, our one neighbor now wants to go with another company that will be closer to $1200. Our back neighbor and other side neighbor however, would rather use someone that quoted us at $16/ft instead of the place our side neighbor is using at $22/ft. That price difference adds up pretty quickly when you’re talking about replacing ~270’ of fence. So that will start trickling in soon, or maybe just all get slammed into March’s spending report. Who knows. We’ll at least save $6/ft on 2/3 of the fence though. Aye yi yi…

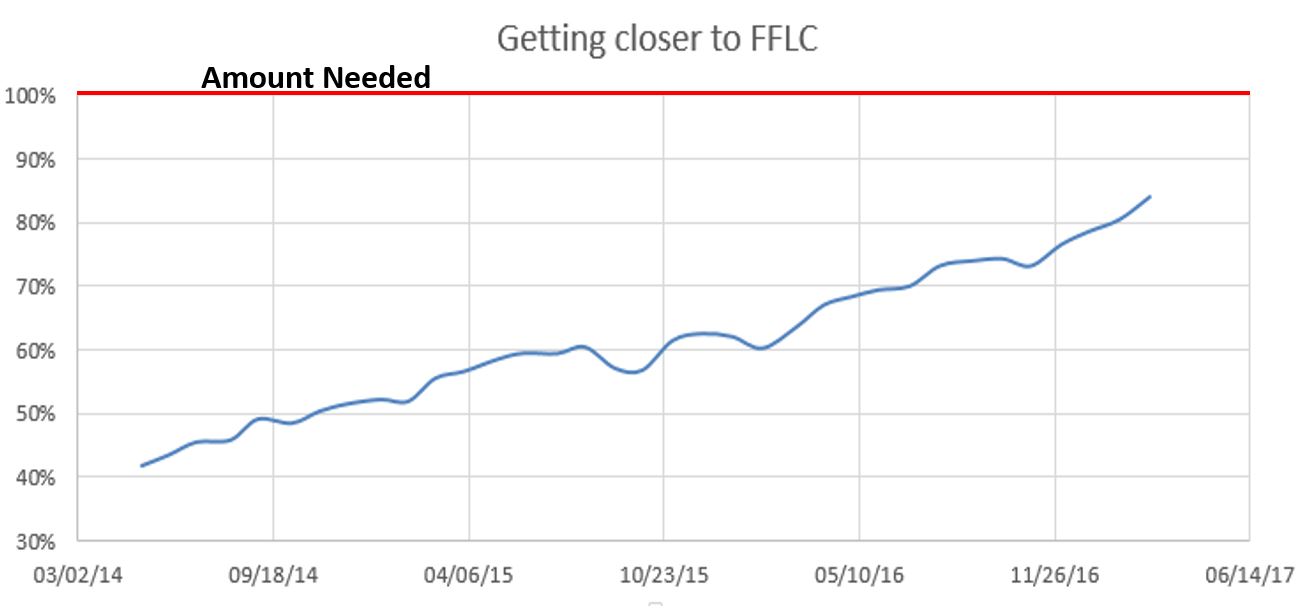

FFLC Update

Looking at the numbers as they stand now, we’re projected to hit our Fully Funded Lifestyle Change (FFLC) number in summer 2018. Of course, that’s assuming no major market correction happens between now and then, so yeah… That sound is me laughing in the background at the thought of that. I welcome it to keep chugging up and up, but somethings gotta give right? Again, who knows? Definitely, not me, the guy who did not major in economics or finance. Our plan is still me working until 2019 anyway, and with being a little more spending conscious we could even stay in Houston on Prof. SSC’s salary and not have to dig into investments immediately.

We also have a good year’s worth of costs in cash currently for when things collapse and we don’t want to sell our stocks at the bottom of the market. Since we’re not planning on living off of this nest egg for a few more years yet, we’re not super worried about a market correction. Plus, when that does happen, maybe I can convince Mrs. SSC to plow some of that stockpile into the markets as they start to recover and we can just replenish the cash stash.

Summary

That’s about it for our spending fun this month. Nothing too exciting or deviating from the norm. We just need to keep an eye on the groceries, and some other minor things, but overall, everything is doing alright. As John Prine said, “Pretty good, not bad, I can’t complain. But actually, everything is just about the same”.

How was your February? Pretty good, not bad, you can’t complain? Any thoughts on sticking more into the college savings or calling it good and helping out with non-529 funds further down the road? Let us know, we’d love to hear your take on it.

Mrs. Picky Pincher

March 6, 2017Aww, I’m sorry to hear your puppers had to go to the doc this month.

It kinda sucks that we have to use the A/C during February here though, huh? Ughhhh. Thankfully our energy bill was great because our Nest thermostat discount posted. Woop!

I love that you guys prioritize college savings in spite of all other bills. Rock on. 🙂

Our February was pretty good. We saved over 50% of our income and applied those savings directly to our student loans. Ahhhh. We were also under-budget on food for the first time in … forever? It’s a great feeling since we’re notorious for over-spending on food. 🙂

Mr SSC

March 7, 2017Yeah definitely using the AC is a bummer. We tried the Nest for a month and it didn’t work well for our house. The location wasn’t in a good spot we walked past enough and we couldn’t customize it with timings and settings like our last one, so we jsut went back to a programmable thermostat. It’s awesome that you get a discount for using it though. Maybe our next house will have the thermostat in a better spot for the Nest.

Nice job on your savings and applying that to your student loans. We figure if we get college knocked out now, then we can use that extra money to invest other places rather than going into their 529 plan. Plus, we’re also assuming we won’t be adding anymore to their college savings once the income quits coming in, so better to stock it now. 🙂

Brian @ Debt Discipline

March 6, 2017I joke with my wife that our dog is higher priority then me in the house. Just have to factor them into to the overall plan. Do you think the $77K will cover it when the kids are ready? Coupled with the FFLC will there be enough free cash on hand to cash-flow more if needed? We had a productive February. Looking for more of the same in March, plus some more daylight. 🙂

Mr SSC

March 7, 2017That is a debate about “what is enough”. I don’t see college rates increasing as being sustainable for what you get out of it. We will push college, but if they want to do something that doesn’t require a degree, there are a lot of those jobs out there as well. Back to the costs, the $77k per kid should be enough to cover a 4 yr state school – again all based on online projections and assumptions – and if it doesn’t we should have enough cash flow and assets to help out.

We feel they should have some skin in the game, but I don’t want them saddled with debt like I was coming out of school. Whether they take loans, find scholarships, or both to cover any shortfall, doesn’t necessarily mean they’re on the hook for repaying them. We may help out with that if it ends up coming to that. We just won’t necessarily tell them or set a bar like 3.75 GPA or higher when you graduate and we’ll cover your loans. I don’t know, we’ll work out something like that.

Congrats on a productive February wth you guys!

Mrs. BITA

March 6, 2017Our spending amounts (though not the exact categories) are rather similar, once you throw in another 2k for our mortgage : /. We superfunded Toddler BITA’s 529 with 48k and we’re not planning to add any more in there. For any surplus needs we will dip into our other accounts. Our dog’s vaccines will come due in April, but he hasn’t had a health issue in ages (knock on wood).

Mr SSC

March 7, 2017See, we are debating that same thing. Is about $48k going to be enough, and if not, we feel we can dip into other accounts, so we should stop around that number as far as adding more money into a 529.

We’re headed back to the vet this afternoon with Zoe. Poor thing has some stomah issues and we want to nip it in the bud since she’s new to the house. Aye yi yi, the pet bills haven’t stopped this year. 🙂 or should it be 🙁

Jacq

March 7, 2017I had coupons for a couple things but ended up restocking on ‘dry goods’ recently, which bumps up my grocery bill for that month, but I’m good on laundry detergent for months now. While it’s good to keep an eye on the increase, consider if it was due to periodic restocking. 🙂

Mr SSC

March 7, 2017I’m pretty sure ours wasn’t general restocking of things unfortunately. That’s a good point though when you need to restock spendier things like vitamins, detergent and all of that it will bump up your bill that month.

Thanks for pointing that out. 🙂

Ellie @ The Chedda

March 7, 2017Lol I did major in economics and I have no idea what Mr. Market will do! The FFLC date is so close! It’s nice that it isn’t as much a lifestyle cliff as a gradual change for you, since Mrs. SSC already changed her lifestyle and you have lots of flexibility. 🙂

Mr SSC

March 7, 2017OMG – that’s a great idea for a post “FFLC isn’t a cliff, but gentle hill”. You’re right with Mrs. SSC already making a major lifestyle change and accompanied income drop we’re weathering it a lot better than if w both did that at the same time. Plus, if she keeps teaching for another 5 or so more years then we’re just waiting on when i can pull the plug and become stay at home dad. There is a LOT of flexibility in the plan.

That comment about majoring in economics and still not knowing did make me laugh, thanks! 🙂

Mrs. COD

March 7, 2017Pets are expensive, man! I love to see those amazing college funds, though! We need to get cracking on those. We will, but we’re also hoping Mr. COD will be teaching at a college that discounts tuition by that time. Summer 2018 doesn’t sound far off for FFLC, yay!

Mr SSC

March 8, 2017Don’t you know it. I was back at the vet last night with the newest greyhound – finicky stomach or who knows what. The diagnosis was “colitis” which sounded like a generic – “tummy troubles” kind of diagnosis, lol.

That’s a good point about teaching at a school that offers discounts. I don’t know if Mrs. SSC would still be teaching then, but something tells me she’ll still be doing something, lol.

Mr. PIE

March 7, 2017Congrats on continuing to push your 529 funds along and executing on your FFLC plan. We discuss endlessly the pros and cons of adding more (or less) to the 529 plans. We have ~$143K in the boys (age 10, 8) 529 plans at Vanguard. We’ll continue to fund those at $1K per month, combined, for the next 16 months before we retire next summer. Then let Mr. Market do whatever he wants to do. With a realistic growth rate (4%) over the next 9 years, we should have ~$225K to use. Like you, we have no idea if one or both boys will gravitate to a college education. Hey, if they don’t then we’d have to suck up the tax hit plus federal penalty clause of 10% to get our hands on it. But what else to do? Can’t really plan for this stuff so far out…..

February was otherwise a great month of us. I had a week long business trip to the UK, and also layered on top a visit to parents in Scotland and old Uni friends. We then skied as a family in Jackson Hole deep pow for a week mid February. Finally, I received my bonus and restricted stock awards last week. Embarrassed (delighted, amazed, gob-smacked, jaw dropping surprise….I don’t know…..) to say the bonus was a very stupid number – 44% of salary. I guess I did something right in 2016. Straight down to Valley Forge with it and dispersed across VWIAX (33%) and VTSAX (67%). Also exercised a bunch of stock that vested and that went to our international equity funds. All will greatly help to support our plan to exit the workplace in July, 2018. It’s getting closer and we started already to do a few minor things to prep the primary home for sale in the spring of 2018.

It all feels very real and very, very exciting..!

Mr SSC

March 8, 2017Mr. PIE, great to hear from you! Glad to hear things have been going well with you guys. I read about your Jackson Hole visit through twitter or comments elsewhere – it sounded amazing. 🙂

Congrats on the kickass bonus! Mine was only about 2/3 of that for salary percentage, but still over double what I was used to at my last company, and wholly unexpected. Cheers to nice unexpected excellent bonuses!!

As far as school, it’s a tricky one to navigate. You can always leave it in there until you “need” it or find a nice sailboat or something that you can’t live without, lol. Another option is if it all doesn’t get spent and grandkids come along, you can change the designee for the account to one of them and they can have a massive warchest to draw from. Just another thing to think about if you end up not ever really needing to withdraw any remainder from the accounts.

That’s so exciting that you’re getting so close, I can only imagine how it must feel knowing you’re less than 16 months away.

Thanks for popping in and giving us the update!

ZJ Thorne

March 7, 2017February had some unexpected expenses. My girlfriend took a job in another state and had three weeks to plan and execute a move. She does not have a license and this complicated planning somewhat. I definitely spent more on meals out than normal, but was able to be helpful to her during the pinch.

Mr SSC

March 8, 2017Oh yeah, the girlfriend move – hopefully that went as well as it could, even with the extra license complications.

Sometimes exceptions have to be made or allowed for in excess spending and knowing that those extra spends aren’t the new normal, is a nice feeling.

Although with our vet spending lately, I’m kind of hoping it’s not oour new normal, sheesh…

Mr. Need2save

March 7, 2017We end up setting aside $75 each month to cover expected vet bills. We had our dog’s teeth cleaned last year and it was something like $300!

On the 529 front, I would cap out around $80k and then just use savings or investments to cover any additional costs. That gives you a bit more freedom depending on what type of financial aid they may receive.

BTW – is that your monthly gym cost? If so, that must be a pretty nice gym.

Mr SSC

March 8, 2017Yeah the teeth cleaning is no joke. With ours they put them under which adds to the cost and risk involved, but waddya do?

We can’t decide what to cap our 529 at – especially not considering a potential school discount if Mrs. SSC is still teaching somewhere at that point. Which seems fairly likely.

Yep, that’s the Lifetime Fitness Family of four cost. Fortunately, my work subsidizes 75% of the cost of a single person plan which amounts to ~$62/month discount. I don’t factor it into that line item, because I don’t enter it monthly for the reimbursment and just submit quarterly batches. We’ll probably just drop it down to a single person when the initial contract is up because Mrs. SSC doesn’t feel like she uses it enough to make it worth it. Even though I take the kids with me once a week on the weekends, and we used it a lot last summer as a family and with swim lessons, it doesn’t seem to be worth the extra family plan costs.

Jason

March 8, 2017I know this might be a projection but does Mrs. SSC plan on continuing to work as a lecturer? If so, your 529 plans might be good. It can’t be guaranteed, but a lot of universities will give children of faculty/staff free tuition or a deep discount. That is why I continue to teach (among other benefits).

Mr SSC

March 15, 2017ahahahaha, she met with a colleague the other week and he told her soon she would feel like the velveteen rabbit. After she realized what he was talking about she was like, “No, I am already a real rabbit, I don’t need the story.” lol So yeah in less than a year she’s got 2 phd students, and found a majorly funded research project that could support 2-3 phd students and provide a lot of publishing opportunities. Yeah man, she’s not retiring before she’s 70. She finally gets to do what she loves, and the detour into oil and gas just gave her more opportunities for research than if she’d followed teaching first.

anyway, yeah, she will most likely be teaching then…

Mustard Seed Money

March 9, 2017Looks like you had a really great month. We were able to save 69.2% of our income and we saw our net worth increase by 3%. So I figure that’s a nice month for us as well 🙂

Mr SSC

March 15, 2017dude! congrats! that’s a great month and yep, we can all be happy for this month. 🙂

Mrs. Groovy

March 10, 2017It’s amazing how the groceries add up especially when you have house guests. You don’t want them seeing all the cheap generic brands you usually buy (at least I don’t!) So, do you count vitamins, detergent, and other cleaning supplies in with groceries? We track those separate from our food costs.

Mr SSC

March 15, 2017Dude, groceries add up even if it’s just me… I think Mrs. SSC just lumps everything grocery related into a category and that’s it. I’m sure it’d look better if some things were categorized differently, but it is what it is. If I have control over it, It’ll get even more general, lol.